Ruedi Maeder (mae)

October 25, 2019

FinTechdigitalisationpayment transactions

Why it is important for web shop operators to have the right partner on board. In addition, six payment service providers for Swiss web shops in comparison.

To anticipate: It is not unconditionally about good or bad, because all payment providers have plus and minus points. In each case depending on the individual requirements of the web shop operator and, above all, on the size and payment volume of an online shop.

The focus is therefore on the question: Which payment provider is the right one for an operator's online shop? Priscilla Wyss, payment expert at Payrexx, has attempted to provide an answer to this question.

What are the main considerations for shop operators?

The right payment connection is of central importance because shop sales are only successful when a customer completes the checkout process and the customer's money also finds its way to the provider quickly and smoothly. Among others, the following points are important:

Smooth checkout process If there is a problem with the payment processing after making a purchase in the web shop, a customer will not complete the checkout process, but will cancel and exit in annoyance. This not only leads to lost sales, it also produces frustrated customers. Comfort, clarity and speed at checkout and in payment processing are not optional, that is simply the expected obligation.

None of the existing payment providers afford bad checkout and payment processing processes. But there are differences. Therefore, every web shop operator is well advised to run through the processes of the individual providers themselves. From the customer's point of view, he can thus assess what will be well received by the buyer segments he is responsible for.

The offer of the means of payment If preferred payment options are missing, this can also lead to the checkout process being aborted. Credit cards, PayPal, Twint, Apple Pay, would you prefer on account or a completely different composition of options? Not all payment providers offer the same methods and options. A web shop operator knows his customers and the preferred payment options that need to be on board so that an order in the checkout can become a paid purchase.

Simple or complex integration How can the payment solution be connected to your own online shop? With a few clicks via the cloud, with little effort via APIs or does it take almost a wrench to connect the web shop and payment solution? Anyone who knows their own options can assess whether a specific solution can be directly integrated or whether external developer support is necessary.

Everything from a single source or cooperation with several partners Depending on the provider and their roles, one or the other is possible.

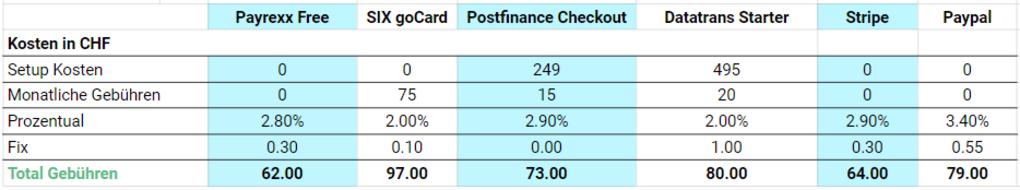

The costs The fees of the various providers differ in terms of setup, the monthly fixed costs and the fees per transaction. The latter are usually variable and dependent on the total turnover generated. Free setup and the waiver of fixed monthly fees is usually bought with higher transaction fees.

A comparison of six payment providers for Swiss online shops

In her study, Priscilla Wyss from Payrexx compares the services and costs of six providers. It is of course no coincidence that Payrexx is included as a provider and does not perform badly. Nevertheless, the comparison is kept neutral, operates with facts and also provides useful basic information.

First the cost comparison

Depending on the monthly sales volume, there are more or less big differences in the costs of the different providers.

Small online shops The graphic below shows a comparison of the monthly fees for a small online shop with a monthly turnover of CHF 2,000 and 20 credit card transactions per month.

Medium-sized online shops The monthly fees of the various payment service providers for a medium-sized online shop with a monthly turnover of CHF 20,000 and 200 credit card transactions per month.

Strengths, weaknesses and cost models of the individual providers

The price comparisons above may vary per provider depending on the package booked and the mix of payment options. For this reason, the author of the study has integrated a short profile for each provider with a profile of strengths and weaknesses, requirements for integrating the solution and the price model used in her comparison system.

Details on this can be found in the document by Priscilla Wyss, available here for free download.

What makes the study even more valuable

The compact paper is intended from the point of view of web shop operators who are evaluating a payment service provider for their shop. A sizable portion of this group doesn't come with an incredible amount of expertise, they just want their shop to be able to handle payment now as well.

That is why the author does not strain the reader's nerves with technical terms and complex contexts, she remains short, concise and restricts herself to the essentials. This includes explaining the roles of different partners in a short theoretical part and breaking down terms that a web shop operator will encounter on the websites of the providers, for example payment service provider, acquiring or payment facilitator.

With this and other practical tips, the author (also) helps operators of small web shops to find the solution that can meet the requirements of their own online shop with the right considerations and the right questions.